Much discussion has taken place over the years regarding the status of vans & conversions with regard to speed limits/tax/insurance etc. There's a wealth of info on the forum - particularly this thread - but it's scattered and fragmented around the forum. So I thought I'd bring it all together into a single post that can be referenced when the subject rears its head again.

The Motor Caravan Conundrum

So you got your panel van (PV) did all the work, (or got someone else to do it) & you're all set to send off the documentation to the DVLA, to get your nice new shiny camper conversion re-registered as a Motor Caravan (MC)... It ain't happening! For reasons only known to themselves, the DVLA will no longer re-classify certain van conversions as Motor Caravans, especially small vans e.g. Transporters. Some may get through if they have a high top for example. But a pop-top doesn't swing it with the DVLA, neither do fancy graphics, wind out awnings etc. Your van will most likely come back as "Van With Windows". Paradoxically if you bought a factory California, it would be classified as a MC, but it would also come with a (eye watering) road tax to match. More of that later.

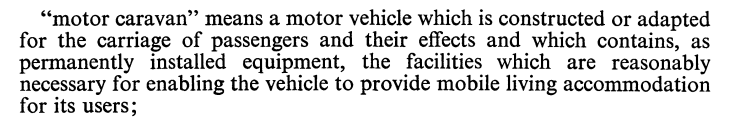

So where does that leave us mere mortals? Fear not, because for once the law is actually on our side. It isn't the DVLA that decides what is a MC or not, the definition of a Motor Caravan is given in the Type Approval Regulations 1979 reg.2 this states that:-

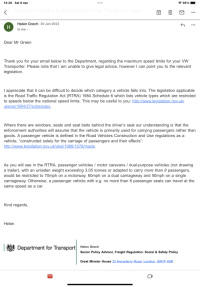

This would indicate that the DVLA are arbitrarily mis-interpreting the legal definition of MC. The DVLA have even had to issue a statement which admits this in a roundabout, not quite admitting it kind of way. Mealy mouthed squirming wriggle statement from DVLA

"The body type does not affect the insurance category of the vehicle, or have any effect on speed limits or other legislative requirements. It is only used for establishing vehicle appearance and identification."

Right! back to your shiny new conversion.

The relevant term here that applies to most of us is "adapted", most of our camper conversions are "Adapted" vehicles from base PVs.

IF your conversion meets the relatively simple & straightforward definition given above, then it's a Motor Caravan in the eyes of the law. What it says on the V5 is irrelevant as admitted by the DVLA in the citation above. If it walks like a duck & quacks......

A word of caution

To qualify as a Motor Caravan, you must comply with the legal definition set out in the TA Regs, slinging a mattress & a sleeping bag in the back of your work van doesn't make it a Motor Caravan. Neither can you carry commercial goods in the back of your Motor Caravan. If you do, you get into the "Living Van" can of worms, which is beyond the scope of this article.

The Taxing Question

When you get your "Van With Windows" V5 back from the DVLA, your van will still have the N1 taxation class. This still has no bearing on whether your van is a MC or not (remember, the LAW decides what is/isn't a MC, not our friends in Swansea) so despite your PV now identifying as a MC, it still only attracts the Light Goods Vehicle Road Tax rates, which is £320 as of 1/4/23. If this was a California it would be closer to £600, as it would have been registered as a MC at first registration. So as you can see, this is actually a win-win for a PV conversion, we get to be a MC, but retain the original lower LGV road tax class. Bear with me , it gets better....

To test or not to test, MOT is the question.

...OK we've established that we now own a MC & not a PV, we've had a little win with the Road Tax, but now we need an MOT. Depending on what the base van was originally, you might have been in the Class 7 MOT category. But now, thanks to the good old Type Approval Regs, we are now a MC, and guess what Motor Caravans are subject to a Class 4 (M1) MOT. If the van had already been tested as a Class 7 & you present it for an MOT as a Motor Caravan, the tester may try to tell you that he has to test it as it had been tested previously. This is wrong, the system allows for the vehicle to be tested "As Presented" If it quacks...

The biggie, how fast can I go?

This is probably the area that causes the most confusion & debate in the whole MC quagmire. So lets dive in with a bold statement:-

IF YOUR VAN NOW IDENTIFIES AS A MOTOR CARAVAN & IS UNDER 3050KG UNLADEN, IT IS SUBJECT TO CAR SPEED LIMITS, INCLUDING 70MPH ON A DUAL CARRIAGEWAY.

Let's pad that statement out & back it up with some facts:-

Speed limits are set out in the 1984 Road Traffic Regulations Act,

As we are now a Motor Caravan, AND we are under 3050kg UNLADEN.

(N.B. All transporters are under 3050kg UL, don't confuse Unladen with MAM. Unladen is the base empty vehicle, used to be Kerb Weight. MAM is Maximum Allowed Mass, which used to be Maximum Gross Vehicle weight.)

HM GOV Speed Limits see paragraph3

And if you're still not convinced.

VOSA Statement regarding Motor Home Speed Limits

To conclude.

There is anecdotal evidence that some people have received NIPs (Notice of Intended Prosecution) after being caught doing over 60mph in their Motor Homes on dual carriageways, these NIPs have subsequently been cancelled when the victim has pointed out to the police that the vehicle is indeed a MC within the definition of the 1979 TA regs. This is a situation caused entirely by the DVLA & they (The DVLA) have been criticised by the Ombudsman for their handling of the situation. Things may change in the future, who knows? But for now, it is what it is. To be fair it isn't the end of the world, if you have a Motor Caravan in the eyes of the Law, then what it says on a piece of paper is irrelevant as we have shown. So don't sweat it, go out & enjoy your van, the law has got your back...for once.

NIP cancelled #1

Information is correct as of 7 April 2023

The Motor Caravan Conundrum

So you got your panel van (PV) did all the work, (or got someone else to do it) & you're all set to send off the documentation to the DVLA, to get your nice new shiny camper conversion re-registered as a Motor Caravan (MC)... It ain't happening! For reasons only known to themselves, the DVLA will no longer re-classify certain van conversions as Motor Caravans, especially small vans e.g. Transporters. Some may get through if they have a high top for example. But a pop-top doesn't swing it with the DVLA, neither do fancy graphics, wind out awnings etc. Your van will most likely come back as "Van With Windows". Paradoxically if you bought a factory California, it would be classified as a MC, but it would also come with a (eye watering) road tax to match. More of that later.

So where does that leave us mere mortals? Fear not, because for once the law is actually on our side. It isn't the DVLA that decides what is a MC or not, the definition of a Motor Caravan is given in the Type Approval Regulations 1979 reg.2 this states that:-

This would indicate that the DVLA are arbitrarily mis-interpreting the legal definition of MC. The DVLA have even had to issue a statement which admits this in a roundabout, not quite admitting it kind of way. Mealy mouthed squirming wriggle statement from DVLA

"The body type does not affect the insurance category of the vehicle, or have any effect on speed limits or other legislative requirements. It is only used for establishing vehicle appearance and identification."

Right! back to your shiny new conversion.

The relevant term here that applies to most of us is "adapted", most of our camper conversions are "Adapted" vehicles from base PVs.

IF your conversion meets the relatively simple & straightforward definition given above, then it's a Motor Caravan in the eyes of the law. What it says on the V5 is irrelevant as admitted by the DVLA in the citation above. If it walks like a duck & quacks......

A word of caution

To qualify as a Motor Caravan, you must comply with the legal definition set out in the TA Regs, slinging a mattress & a sleeping bag in the back of your work van doesn't make it a Motor Caravan. Neither can you carry commercial goods in the back of your Motor Caravan. If you do, you get into the "Living Van" can of worms, which is beyond the scope of this article.

The Taxing Question

When you get your "Van With Windows" V5 back from the DVLA, your van will still have the N1 taxation class. This still has no bearing on whether your van is a MC or not (remember, the LAW decides what is/isn't a MC, not our friends in Swansea) so despite your PV now identifying as a MC, it still only attracts the Light Goods Vehicle Road Tax rates, which is £320 as of 1/4/23. If this was a California it would be closer to £600, as it would have been registered as a MC at first registration. So as you can see, this is actually a win-win for a PV conversion, we get to be a MC, but retain the original lower LGV road tax class. Bear with me , it gets better....

To test or not to test, MOT is the question.

...OK we've established that we now own a MC & not a PV, we've had a little win with the Road Tax, but now we need an MOT. Depending on what the base van was originally, you might have been in the Class 7 MOT category. But now, thanks to the good old Type Approval Regs, we are now a MC, and guess what Motor Caravans are subject to a Class 4 (M1) MOT. If the van had already been tested as a Class 7 & you present it for an MOT as a Motor Caravan, the tester may try to tell you that he has to test it as it had been tested previously. This is wrong, the system allows for the vehicle to be tested "As Presented" If it quacks...

The biggie, how fast can I go?

This is probably the area that causes the most confusion & debate in the whole MC quagmire. So lets dive in with a bold statement:-

IF YOUR VAN NOW IDENTIFIES AS A MOTOR CARAVAN & IS UNDER 3050KG UNLADEN, IT IS SUBJECT TO CAR SPEED LIMITS, INCLUDING 70MPH ON A DUAL CARRIAGEWAY.

Let's pad that statement out & back it up with some facts:-

Speed limits are set out in the 1984 Road Traffic Regulations Act,

As we are now a Motor Caravan, AND we are under 3050kg UNLADEN.

(N.B. All transporters are under 3050kg UL, don't confuse Unladen with MAM. Unladen is the base empty vehicle, used to be Kerb Weight. MAM is Maximum Allowed Mass, which used to be Maximum Gross Vehicle weight.)

HM GOV Speed Limits see paragraph3

And if you're still not convinced.

VOSA Statement regarding Motor Home Speed Limits

To conclude.

There is anecdotal evidence that some people have received NIPs (Notice of Intended Prosecution) after being caught doing over 60mph in their Motor Homes on dual carriageways, these NIPs have subsequently been cancelled when the victim has pointed out to the police that the vehicle is indeed a MC within the definition of the 1979 TA regs. This is a situation caused entirely by the DVLA & they (The DVLA) have been criticised by the Ombudsman for their handling of the situation. Things may change in the future, who knows? But for now, it is what it is. To be fair it isn't the end of the world, if you have a Motor Caravan in the eyes of the Law, then what it says on a piece of paper is irrelevant as we have shown. So don't sweat it, go out & enjoy your van, the law has got your back...for once.

NIP cancelled #1

Information is correct as of 7 April 2023

Last edited:

. As I pointed out earlier, there is also a definition of a “Dual Purpose” vehicle in the 1979 Type Approval regs. It needs someone to collate the info, give relevant links & citations for MPVs as I did for MCs. I can’t see any difference between converting a van into a MPV as there is in converting one to a MC. As long as it meets the legal definition & quacks. Folk can guess & assume as much as they like, but at the end of the day, that’s all it is, guesstimation. The problem will be, far fewer people go the PV-MPV route as go the PV-MC route, so the information will be thinner on the ground. Also the PV-MC route has been tested in Law, who’s going to be the brave one to test the PV-MPV scenario?

. As I pointed out earlier, there is also a definition of a “Dual Purpose” vehicle in the 1979 Type Approval regs. It needs someone to collate the info, give relevant links & citations for MPVs as I did for MCs. I can’t see any difference between converting a van into a MPV as there is in converting one to a MC. As long as it meets the legal definition & quacks. Folk can guess & assume as much as they like, but at the end of the day, that’s all it is, guesstimation. The problem will be, far fewer people go the PV-MPV route as go the PV-MC route, so the information will be thinner on the ground. Also the PV-MC route has been tested in Law, who’s going to be the brave one to test the PV-MPV scenario?